Decrease in oil: savings of 15 billion euros for France in 2015

By Ludovic Dupin - Posted on February 03, 2015, Usine Nouvelle

In 2015, France could reduce the cost of its oil and gas imports by almost 30% compared to 2014. But it remains very dependent on producing countries.

With the drop in oil prices, the prices of which have been cut in half over the last six months to reach less than 50 dollars per barrel, many producing countries are looking gray as they calculate their budget balance on a higher price. This is the case of Iran, Nigeria, Russia, Algeria ...

On the other hand, for importing countries, it is a real breath of fresh air. According to data from the French Institute of Petroleum Energies New (Ifpen), the energy bill of France could decrease by 15 billion euros in 2015, considering that the barrel will remain on average at 60 dollars over the year.

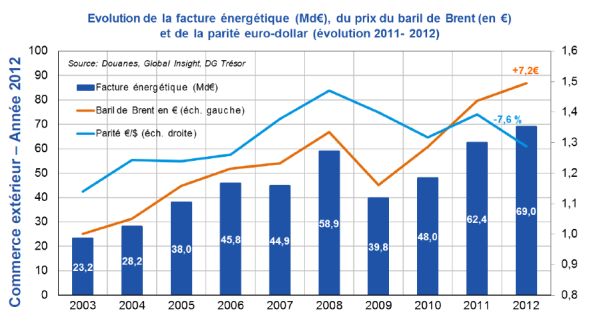

Thus, the French energy bill (imports of oil and gas) should be around 40 billion euros in 2015, against 55 billion euros in 2014. Last year, France had already saved a lot thanks to lower prices in the second half. In 2013, the same bill reached 65 billion euros.

EFFECT ON GDP

With a bill of 40 billion euros, France finds itself in the situation of 2009 (39,8 billion euros) which had been marked by the terrible global economic slowdown. However, it remains far from the end of the 90s and the beginning of the 2000s when, thanks to very low oil prices, the energy bill was between 10 and 20 billion dollars. With these savings, France can count on GDP growth of 0,7%. The same positive effects are found in all the major importing countries such as Japan, which could gain 1,6% of GDP or China (+ 0,7%).

The improvement in the French energy bill should not, however, mask the fact that the country continues to be overwhelmingly dependent on producing countries. France imports more than 98% of the gas and oil it consumes each year. In the energy transition law, the country is expected to initiate a reduction in its consumption of fossil fuels by 30% by 2030.

http://www.usinenouvelle.com/editorial/ ... 15.N311345