Hello,

I was wondering if we had reached the pick oil in 2008 which was responsible for the soaring oil prices that we experienced which itself caused the crisis?

Peak oil and international crisis?

-

the middle

- Econologue expert

- posts: 4075

- Registration: 12/01/07, 08:18

- x 4

Hello,

It seems to me that there is another post that talks about this subject; that said, I just heard Arte talk about pic oil in 40 years!

More fun, my ex-head of "total" , 20 years ago, said to me, petroleum, THERE IS STILL FOR 20 YEARS. well, there are always ....

, 20 years ago, said to me, petroleum, THERE IS STILL FOR 20 YEARS. well, there are always ....

If other energies take over, the peak oil vat recede, but for now, it looks like we are in the middle ... see even on the other side of the mountain, but it is not seen .

It seems to me that there is another post that talks about this subject; that said, I just heard Arte talk about pic oil in 40 years!

More fun, my ex-head of "total"

If other energies take over, the peak oil vat recede, but for now, it looks like we are in the middle ... see even on the other side of the mountain, but it is not seen .

0 x

Man is by nature a political animal (Aristotle)

-

Christophe

- Moderator

- posts: 79332

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11046

Good note ... thank you for asking but we had already asked.

Not sure that this is Peak Oil, in any case the fact that there were 6 weeks between the listing at $ 150 in mid July 2008 and the worsening of the crisis at the beginning of September 2008 corresponds to the average time for "listing - sale "on the oil market ...

In short: the worsening of the crisis is perhaps (probably?) Linked to this over-rating ...

If it had been peak oil (fundamental = law of supply and demand) the barrel would not have dropped to less than $ 30: its quotation, which is currently going up, is only PURE speculation! Indeed: the crisis has only had an infinite impact on world crude consumption ...

In short, this quotation at $ 150 was perhaps a "test" to see what the "system" can absorb ... strongly the following

Not sure that this is Peak Oil, in any case the fact that there were 6 weeks between the listing at $ 150 in mid July 2008 and the worsening of the crisis at the beginning of September 2008 corresponds to the average time for "listing - sale "on the oil market ...

In short: the worsening of the crisis is perhaps (probably?) Linked to this over-rating ...

If it had been peak oil (fundamental = law of supply and demand) the barrel would not have dropped to less than $ 30: its quotation, which is currently going up, is only PURE speculation! Indeed: the crisis has only had an infinite impact on world crude consumption ...

In short, this quotation at $ 150 was perhaps a "test" to see what the "system" can absorb ... strongly the following

0 x

Do a image search or an text search - Netiquette of forum

We are already at Peak ...

Except that with the crisis, what should have been a peak becomes a plateau more or less vacillating with the stock market shakes and economic slowdown / recovery.

But let's be sure of one thing, the plateau on average will go down in the coming years.

And $ 150 / barrel will seem very cheap in 5 or 10 years.

Except that with the crisis, what should have been a peak becomes a plateau more or less vacillating with the stock market shakes and economic slowdown / recovery.

But let's be sure of one thing, the plateau on average will go down in the coming years.

And $ 150 / barrel will seem very cheap in 5 or 10 years.

0 x

Christophe wrote:... the crisis has only affected world crude oil consumption infinitely ...

Without calling into question the aspects of speculation, it should be noted that consumption (and production) has varied in proportions all the same more than "minutely".

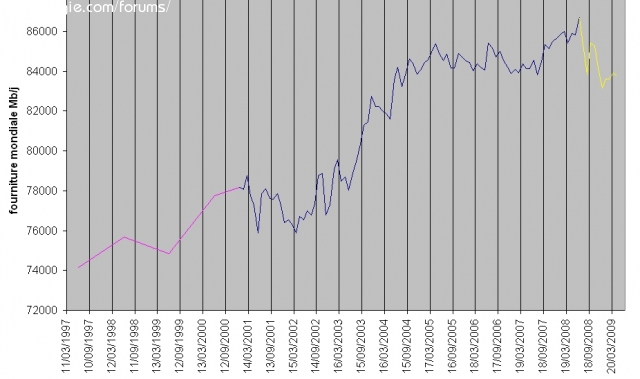

see the graph below

to come back to peak-oil, given the embarrassment embarrassment of the OPEC countries in 2008 who refused to open more taps, I actually think they were not far if not at maximum flow.

and pity, once again, thank you not to confuse the "end" of oil and the maximum production which are not at all the same thing. we will probably not see (nor our children) the end of oil but on the other hand a drop in production of the order of 4 to 8% per year, we will take it in full head!

0 x

-

Christophe

- Moderator

- posts: 79332

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11046

Ah well this curve. Where did you find it?

We arrive at the level of 2004, despite the ENORMISSIME CRISIS that we are currently undergoing, worse than 1929 is said ...

Sorry but there is something wrong.

Otherwise you could trace it by putting 0 at the origin of the ordinates? It will be more "clear" compared to what I wanted to say: the variations in consumption of crude linked to the crisis = peanuts!

Thank you

ps: I made a slip I obviously wanted to say: infinitesimally (spelling to check)

We arrive at the level of 2004, despite the ENORMISSIME CRISIS that we are currently undergoing, worse than 1929 is said ...

Sorry but there is something wrong.

Otherwise you could trace it by putting 0 at the origin of the ordinates? It will be more "clear" compared to what I wanted to say: the variations in consumption of crude linked to the crisis = peanuts!

Thank you

ps: I made a slip I obviously wanted to say: infinitesimally (spelling to check)

0 x

Do a image search or an text search - Netiquette of forum

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: Peak oil and international crisis?

Kapitch wrote:Hello,

I was wondering if we had reached the pick oil in 2008 which was responsible for the soaring oil prices that we experienced which itself caused the crisis?

Oil production in August 2008 has not been exceeded since.

It may be the peak.

I endure the maximum oil production for whatever reason.

If the crisis continues there will not be enough new investment to counter the decline in giant fields like Cantarell in Mexico.

see also this thread on Oleocene: http://forums.oleocene.org/viewsujet.ph ... 61#p221461

0 x

@christopher

it is a personal excel doc which I update as and when and in particular with the info of theEIA

not to be confused with the IEA or IEA

it is a personal excel doc which I update as and when and in particular with the info of theEIA

not to be confused with the IEA or IEA

0 x

Excellent Kapitch question !!

Besides, it's time to talk a little bit about peak-oil, it's still almost the alpha and omega of the problems that we have. And it’s so rich, complicated and dense as a subject !! I recall the excellent forum http://www.oleocene.org/ for those who like the pic like me.

I will cut your question into several ends because it is a bit of a catch-all.

Have we reached the peak_oil?

I think roughly yes. More exactly, we are on the wavy plateau, if I believe the figures of the EIA (I too am addicted to the oil figures).

Was he responsible for the soaring prices of 2008?

Not really. It is clearly a speculative effect which caused the barrel to flare up, probably moreover with the awareness of the imminence of the peak by the markets. $ 150 was clearly an anomaly, but - to bounce back on what Christophe said - $ 30 is just as abnormal and also results from speculation, but downward. I would say that a normal price is in the $ 60-70 range (without major change in currencies)

Did it cause the crisis?

Partly I think of the reason for the enormous prices achieved. But let's not forget that finance and banksters did not need the spike to screw the mess up on their own. However, a high barrel does not help GDP.

And I add a question that is debating on oleocene: will the price explode with depletion or will there be a ceiling price?

There may be a cap. After a certain price, the economy decreases, consumption too, prices go down. Then the economy starts up again a little, the price goes up until it returns to the "crisis" price. And so on. The whole question is, where is this crisis price? Maybe in the $ 100-150 range. This hypothesis leads to a latent decrease, a long, soft crisis that will last for decades. The other hypothesis of prices suddenly reaching stratospheric prices leads instead to a sharp collapse. It's very different in terms of the impact on societies. But at the end of the ends we decrease massively anyway.

Besides, it's time to talk a little bit about peak-oil, it's still almost the alpha and omega of the problems that we have. And it’s so rich, complicated and dense as a subject !! I recall the excellent forum http://www.oleocene.org/ for those who like the pic like me.

I will cut your question into several ends because it is a bit of a catch-all.

Kapitch wrote:I was wondering if we had reached the pick oil in 2008 which was responsible for the soaring oil prices that we experienced which itself caused the crisis?

Have we reached the peak_oil?

I think roughly yes. More exactly, we are on the wavy plateau, if I believe the figures of the EIA (I too am addicted to the oil figures).

Was he responsible for the soaring prices of 2008?

Not really. It is clearly a speculative effect which caused the barrel to flare up, probably moreover with the awareness of the imminence of the peak by the markets. $ 150 was clearly an anomaly, but - to bounce back on what Christophe said - $ 30 is just as abnormal and also results from speculation, but downward. I would say that a normal price is in the $ 60-70 range (without major change in currencies)

Did it cause the crisis?

Partly I think of the reason for the enormous prices achieved. But let's not forget that finance and banksters did not need the spike to screw the mess up on their own. However, a high barrel does not help GDP.

And I add a question that is debating on oleocene: will the price explode with depletion or will there be a ceiling price?

There may be a cap. After a certain price, the economy decreases, consumption too, prices go down. Then the economy starts up again a little, the price goes up until it returns to the "crisis" price. And so on. The whole question is, where is this crisis price? Maybe in the $ 100-150 range. This hypothesis leads to a latent decrease, a long, soft crisis that will last for decades. The other hypothesis of prices suddenly reaching stratospheric prices leads instead to a sharp collapse. It's very different in terms of the impact on societies. But at the end of the ends we decrease massively anyway.

0 x

additional information that has just fallen:

an interview with Sadad al Husseini: retired Geologist engineer from Aramco, the national oil company of Saudi Arabia.

Despite optimism about Saudi production capacity, the interview clearly poses the problem that nobody is talking about and that hangs in our face, an offer that can no longer meet demand.

and it's not for in 15 years neither 10 nor 5 ...

an article to convince the incredulous

source

French translation (by the counter-info site)

Sadad Al Husseini "speaks with Dave Bowden and Steve Andrews for ASPO USA, September 28, 2009

Sadad: I am a geologist by training and an engineer in the oil fields - a production engineer - from my experience. I started at Aramco in 1970 and I have been retired since 2004. I spent a lot of time on exploration and production activities but also in project management. I then continued as a consultant.

Question: Let us assume that the decline in demand has stabilized and that modest growth will appear in about a year. Are there new petroleum projects underway to meet increased demand in the coming years?

Sadad: I have followed many projects, worldwide, for a long time both in the Middle East and in the rest of the world - Russia, Brazil, West Coast of Africa ... Lots of information on these projects are in the public domain, so there are no mysteries. The International Energy Agency (IEA) recently published these same figures. The bottom line is that there are not enough projects. There is no new production capacity to come, say in the next five to six years, to compensate for the decline in world production. And this supposes a very moderate drop - 6% to 6.5% for producers outside OPEC, and perhaps 3.5% to 4% for OPEC.

Even with these modest decline rates, we will in fact be witnessing production shortfalls in the next two or three years. We are currently lulled by excess capacity which has more to do with weak demand than with production. So we have a short-term problem. In the longer term it is even worse because the time required to discover, develop and put into production an oil exploitation is 10 years. Long-term efforts are also insufficient. It is both a short-term and a long-term problem.

Question: For Saudi Arabia, the production which is currently 12,5 million barrels per day is it sustainable and are there plans to increase this capacity?

Sadad: Saudi Arabia is very credible and very professional regarding the publication of its capacities and the respect of its production objectives. When the kingdom announced the objective of a production capacity of 12,5 million barrels per day, it really committed funds to finance this capacity and we see today that it puts into service: 250 barrels / additional day in Shaybah, 000 million in Khurais, 1,2 in Khursaniyah and 500 to come in about two years in Manifa. These projects and these capacities are therefore very real. I do not think it will be a problem for Saudi Arabia to deliver the production it announces. The question is: what about the rest of the world? Will he be able to tell the difference?

If we consider the 85 to 90 million barrels produced per day, Saudi Arabia delivers 12,5 million barrels, who will be able to produce the difference and what effort will be necessary to achieve this? And with production declining from 7% to 8% [per year], 4 or 5 million barrels per day of new capacity should come from new projects. So that's the challenge. I don't think the problem is Saudi Arabia. I think the problem comes from the rest of the world.

Question: Why do you think there is such a denial that oil production is approaching or has already reached a plateau?

Sadad: There is resistance to accepting this notion of a global oil supply plateau, which is largely based on a lack of information or a lack of curiosity. In fact, if we look at the information published - for example the annual report of the British Petroleum - it very clearly indicates that since 2003 production has barely increased. So the information is available. If you look at the advertisements that Chevron has been using for a few years, they clearly say that we have used half of the world's reserves. The information is there. The facts are there. Oil prices have not jumped as much in three or four years for another reason than a lack of production. Admittedly, there has been volatility recently in 2008, but the upward trend has reappeared since 2002-2003. So these are realities and these resistances show that in a certain way the market does not know how to take into account these realities, that somewhere people cannot face these realities.

On the other hand, if we do not address these problems, we will not improve the situation. The situation is not going to get better. It’s going to get worse because there’s a growing population all over the world, and living standards are improving all over the world, there are aspirations for a better quality of life all over the world, and people want to energy. It is therefore important to talk about the facts and come up with solutions rather than pretend that these problems do not exist and wait for solutions to come out of nowhere. It is the role of governments to highlight these problems and find solutions, or at least to reflect on them, to try to solve them. So I think this resistance is probably unwise.

Question: In your opinion, what place will unconventional hydrocarbons occupy in the future?

Sadad: I think it is very important to understand the difference between conventional oil projects and projects on unconventional deposits, such as extra-heavy crudes. The IEA published in 2008 a report on the long-term prospects. They have identified all kinds of projects. If we observe as I did the conventional petroleum projects, and that we count the cumulative capacity compared to the cumulative cost, we arrive at 30 to 000 dollars per barrel of daily production capacity of conventional oil [32]. So much for projects from 000 to 1.

Looking at unconventional oils, like Canada's extra heavy, in which I have included two Qatari gas to liquid fuel conversion projects, the cost per barrel of production capacity is $ 92. It is three times the cost of conventional oil.

This means that if you want 100 barrels of unconventional oil (synthetic crude), you have to invest $ 000 billion. And these are just the costs right now. For conventional oil, when we can find it, it is $ 9 billion per 3 barrels / day. But even conventional oil has become very expensive. If you look at the Tengiz and Kashagans fields, we invested 100 to 000 billion dollars to obtain 40 to 50 barrels of oil per day. Everything becomes much more expensive and slower to develop.

I think we will be using synthetic oil. During the Second World War, the Germans used fuels obtained from coal, but it was a very expensive solution. We cannot replace the 80 million barrels consumed every day with fuels produced from coal. These will be important complements, but not replacements.

Question: Will the net energy costs associated with unconventional oil resources be a major obstacle to their development?

Sadad: There is no doubt that the energy required for the extraction of extra-heavy crudes, whether in the form of fuels such as natural gas, to heat the bitumens liquefy them, or in terms of the operating process surface mining - where two tonnes of sand are extracted per barrel of oil - then in cracking and refining, in order to convert them into synthetic crudes, these costs are very high.

It is the same for the fuel industry obtained from gas; basically we consume a third of the gas to deliver the other two thirds in liquid form. So these have diminishing returns. Certainly, we will be able to produce. I think everyone predicts that 4 to 5 million barrels a day will be obtained from unconventional crudes, and that may reach 8 or even 10 million barrels by 2030. But 8 million barrels per day represent only 10 percent of total consumption. This is not a solution.

Question: Recently there have been numerous announcements of discoveries of new oil fields. How do you see this? When and how will they be able to contribute to global supply?

Sadad: There have been a regular number of discoveries in the last, say five to ten years, in terms of important fields, and even giant deposits, for example in the great depths of the Gulf of Mexico. But these are very expensive deposits. When you drill a well that costs between $ 80 and $ 90 million, that well does not tell you what the reserves are, and you have to drill four or five more wells to determine them. Then we have to find a way to fragment what is fundamentally rock at this depth. It becomes fields whose development is very expensive.

The fields of West Africa, for example in Angola, are a great success in terms of exploration, but we are now moving towards the deep continental shelf, and we are running out of areas of concessions, of usable areas. In Brazil, the Tupi deposit is a fantastic discovery. Geophysically speaking, the seismic data were superb, the precision of its delimitation is marvelous. These are formations that should have a lot of permeability.

On the other hand, [with some of these new discoveries] there is the problem of paraffin crudes, very acid gas which must be separated from production and reinjected into the tank. You have salt areas that are very plastic and could be a problem in terms of maintaining well integrity. There are therefore many challenges for these fields, which will require technological innovations. Yes, there have been discoveries, they are important, but their development will be slow.

If Tupi, which was discovered a few years ago, isn't in production until 2017 or 2018, it's a long time to wait. What is the target [of the production of these new deposits]? One million barrels a day. The production declines will have exceeded this level long before, and certainly in Brazil itself. So we are basically in the same situation.

an interview with Sadad al Husseini: retired Geologist engineer from Aramco, the national oil company of Saudi Arabia.

Despite optimism about Saudi production capacity, the interview clearly poses the problem that nobody is talking about and that hangs in our face, an offer that can no longer meet demand.

and it's not for in 15 years neither 10 nor 5 ...

an article to convince the incredulous

source

French translation (by the counter-info site)

Sadad Al Husseini "speaks with Dave Bowden and Steve Andrews for ASPO USA, September 28, 2009

Sadad: I am a geologist by training and an engineer in the oil fields - a production engineer - from my experience. I started at Aramco in 1970 and I have been retired since 2004. I spent a lot of time on exploration and production activities but also in project management. I then continued as a consultant.

Question: Let us assume that the decline in demand has stabilized and that modest growth will appear in about a year. Are there new petroleum projects underway to meet increased demand in the coming years?

Sadad: I have followed many projects, worldwide, for a long time both in the Middle East and in the rest of the world - Russia, Brazil, West Coast of Africa ... Lots of information on these projects are in the public domain, so there are no mysteries. The International Energy Agency (IEA) recently published these same figures. The bottom line is that there are not enough projects. There is no new production capacity to come, say in the next five to six years, to compensate for the decline in world production. And this supposes a very moderate drop - 6% to 6.5% for producers outside OPEC, and perhaps 3.5% to 4% for OPEC.

Even with these modest decline rates, we will in fact be witnessing production shortfalls in the next two or three years. We are currently lulled by excess capacity which has more to do with weak demand than with production. So we have a short-term problem. In the longer term it is even worse because the time required to discover, develop and put into production an oil exploitation is 10 years. Long-term efforts are also insufficient. It is both a short-term and a long-term problem.

Question: For Saudi Arabia, the production which is currently 12,5 million barrels per day is it sustainable and are there plans to increase this capacity?

Sadad: Saudi Arabia is very credible and very professional regarding the publication of its capacities and the respect of its production objectives. When the kingdom announced the objective of a production capacity of 12,5 million barrels per day, it really committed funds to finance this capacity and we see today that it puts into service: 250 barrels / additional day in Shaybah, 000 million in Khurais, 1,2 in Khursaniyah and 500 to come in about two years in Manifa. These projects and these capacities are therefore very real. I do not think it will be a problem for Saudi Arabia to deliver the production it announces. The question is: what about the rest of the world? Will he be able to tell the difference?

If we consider the 85 to 90 million barrels produced per day, Saudi Arabia delivers 12,5 million barrels, who will be able to produce the difference and what effort will be necessary to achieve this? And with production declining from 7% to 8% [per year], 4 or 5 million barrels per day of new capacity should come from new projects. So that's the challenge. I don't think the problem is Saudi Arabia. I think the problem comes from the rest of the world.

Question: Why do you think there is such a denial that oil production is approaching or has already reached a plateau?

Sadad: There is resistance to accepting this notion of a global oil supply plateau, which is largely based on a lack of information or a lack of curiosity. In fact, if we look at the information published - for example the annual report of the British Petroleum - it very clearly indicates that since 2003 production has barely increased. So the information is available. If you look at the advertisements that Chevron has been using for a few years, they clearly say that we have used half of the world's reserves. The information is there. The facts are there. Oil prices have not jumped as much in three or four years for another reason than a lack of production. Admittedly, there has been volatility recently in 2008, but the upward trend has reappeared since 2002-2003. So these are realities and these resistances show that in a certain way the market does not know how to take into account these realities, that somewhere people cannot face these realities.

On the other hand, if we do not address these problems, we will not improve the situation. The situation is not going to get better. It’s going to get worse because there’s a growing population all over the world, and living standards are improving all over the world, there are aspirations for a better quality of life all over the world, and people want to energy. It is therefore important to talk about the facts and come up with solutions rather than pretend that these problems do not exist and wait for solutions to come out of nowhere. It is the role of governments to highlight these problems and find solutions, or at least to reflect on them, to try to solve them. So I think this resistance is probably unwise.

Question: In your opinion, what place will unconventional hydrocarbons occupy in the future?

Sadad: I think it is very important to understand the difference between conventional oil projects and projects on unconventional deposits, such as extra-heavy crudes. The IEA published in 2008 a report on the long-term prospects. They have identified all kinds of projects. If we observe as I did the conventional petroleum projects, and that we count the cumulative capacity compared to the cumulative cost, we arrive at 30 to 000 dollars per barrel of daily production capacity of conventional oil [32]. So much for projects from 000 to 1.

Looking at unconventional oils, like Canada's extra heavy, in which I have included two Qatari gas to liquid fuel conversion projects, the cost per barrel of production capacity is $ 92. It is three times the cost of conventional oil.

This means that if you want 100 barrels of unconventional oil (synthetic crude), you have to invest $ 000 billion. And these are just the costs right now. For conventional oil, when we can find it, it is $ 9 billion per 3 barrels / day. But even conventional oil has become very expensive. If you look at the Tengiz and Kashagans fields, we invested 100 to 000 billion dollars to obtain 40 to 50 barrels of oil per day. Everything becomes much more expensive and slower to develop.

I think we will be using synthetic oil. During the Second World War, the Germans used fuels obtained from coal, but it was a very expensive solution. We cannot replace the 80 million barrels consumed every day with fuels produced from coal. These will be important complements, but not replacements.

Question: Will the net energy costs associated with unconventional oil resources be a major obstacle to their development?

Sadad: There is no doubt that the energy required for the extraction of extra-heavy crudes, whether in the form of fuels such as natural gas, to heat the bitumens liquefy them, or in terms of the operating process surface mining - where two tonnes of sand are extracted per barrel of oil - then in cracking and refining, in order to convert them into synthetic crudes, these costs are very high.

It is the same for the fuel industry obtained from gas; basically we consume a third of the gas to deliver the other two thirds in liquid form. So these have diminishing returns. Certainly, we will be able to produce. I think everyone predicts that 4 to 5 million barrels a day will be obtained from unconventional crudes, and that may reach 8 or even 10 million barrels by 2030. But 8 million barrels per day represent only 10 percent of total consumption. This is not a solution.

Question: Recently there have been numerous announcements of discoveries of new oil fields. How do you see this? When and how will they be able to contribute to global supply?

Sadad: There have been a regular number of discoveries in the last, say five to ten years, in terms of important fields, and even giant deposits, for example in the great depths of the Gulf of Mexico. But these are very expensive deposits. When you drill a well that costs between $ 80 and $ 90 million, that well does not tell you what the reserves are, and you have to drill four or five more wells to determine them. Then we have to find a way to fragment what is fundamentally rock at this depth. It becomes fields whose development is very expensive.

The fields of West Africa, for example in Angola, are a great success in terms of exploration, but we are now moving towards the deep continental shelf, and we are running out of areas of concessions, of usable areas. In Brazil, the Tupi deposit is a fantastic discovery. Geophysically speaking, the seismic data were superb, the precision of its delimitation is marvelous. These are formations that should have a lot of permeability.

On the other hand, [with some of these new discoveries] there is the problem of paraffin crudes, very acid gas which must be separated from production and reinjected into the tank. You have salt areas that are very plastic and could be a problem in terms of maintaining well integrity. There are therefore many challenges for these fields, which will require technological innovations. Yes, there have been discoveries, they are important, but their development will be slow.

If Tupi, which was discovered a few years ago, isn't in production until 2017 or 2018, it's a long time to wait. What is the target [of the production of these new deposits]? One million barrels a day. The production declines will have exceeded this level long before, and certainly in Brazil itself. So we are basically in the same situation.

0 x

Back to "New transport: innovations, engines, pollution, technologies, policies, organization ..."

Who is online ?

Users browsing this forum : No registered users and 327 guests