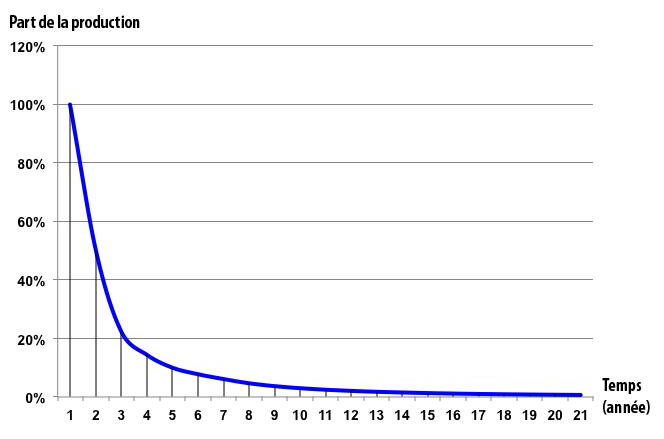

https://energieetenvironnement.com/2018 ... es-dettes/We already know that the American oil industry is highly indebted, but that's only part of its problems. Its debt service is very high and at the current rate of profit on oil, the resource will probably be exhausted before the industry has managed to repay its creditors. Why lend money from the industry in its conditions? Because the finance sector is gaining in the short term and it hopes to pass the debt to others before the bubble burst.

Why are we lending to oil companies?

If the repayment is so uncertain, why is the finance industry lending to the oil companies? Beyond the effects of advertisements and financial prospectuses with suspicious optimism, we can mention four main reasons:

The sector is in deficit as a whole, but about 40% of companies still make some profits. These examples maintain the hope of profitable discoveries for loss-making companies.

The oil companies' bonds offer excellent returns, in a world where fee-based investments are scarce.

Much of the money lent comes not from the capital of the financial sector, but from money entrusted by pension funds or mutual funds - the risk is therefore borne by third parties.

ext ext ...

The wall is fast approaching.