"Collapsologist Pablo Servigne (independent researcher, author and lecturer) presented the results of his research revolving around the questioning of our way of life based on the use of fossil fuels."

Spent oil PeakOil 2005, 2015 depletion?

-

Christophe

- Moderator

- posts: 79323

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11042

Re: PeakOil tanker switched to 2005, depletion in 2015?

Interesting conference to get up to date, beware it is a "collapsologist" ...

"Collapsologist Pablo Servigne (independent researcher, author and lecturer) presented the results of his research revolving around the questioning of our way of life based on the use of fossil fuels."

"Collapsologist Pablo Servigne (independent researcher, author and lecturer) presented the results of his research revolving around the questioning of our way of life based on the use of fossil fuels."

0 x

Do a image search or an text search - Netiquette of forum

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

World oil demand expected to decline in 2020, a first since 2009

REUTERS • 09 / 03 / 2020

Global demand for oil is expected to drop this year for the first time since 2009 as the global economy is slowed by the coronavirus epidemic from China, the International Energy Agency predicted on Monday.

The IEA now expects demand of 99,9 million barrels per day (bpd) in 2020, almost a million bpd less than in its previous forecast. This would represent a contraction of 90.000 bpd compared to 2019.

Once this shock has passed, it predicts a rebound in 2021 with an increase in demand of 2,1 million bpd.

The agency released its new forecast as oil prices plummet by around 20% on Monday. In parallel with the fears on demand linked to the coronavirus, Saudi Arabia decided over the weekend to relaunch a price war and to increase its market supply in the face of Russia's refusal of a further coordinated decrease in production.

Faced with this situation, Fatih Birol, director of the IEA, warned that "playing Russian roulette on the oil markets could well have serious consequences".

He notably mentioned a halt to new shale projects in the United States in the event of a barrel of less than 25 dollars. American light crude was traded late Monday morning at around $ 32 and North Sea Brent at just over $ 35.

The IEA considers it possible that excess supply on the oil market could reach 3,5 million bpd in the first quarter due to the coronavirus epidemic, said Fatih Birol.

https://www.boursorama.com/actualite-ec ... 5219010b96

1 x

-

Christophe

- Moderator

- posts: 79323

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11042

Re: PeakOil tanker switched to 2005, depletion in 2015?

Ah? Did it go down in 2009?

How long? How many%?

How long? How many%?

1 x

Do a image search or an text search - Netiquette of forum

Re: PeakOil tanker switched to 2005, depletion in 2015?

yeah finally we're still at 100 million barrels a day ...

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

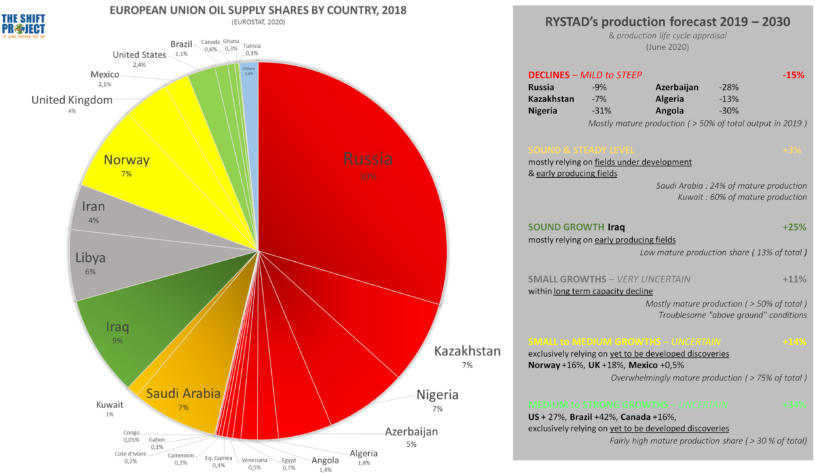

POSSIBLE DECLINE OF EU OIL SUPPLY BY 2030: THE NEW SHIFT STUDY ON THE “OIL PIC”

23th June 2020

The majority of current sources of oil in the European Union are threatening to decline by 2030, according to an analysis by the Shift Project based on exclusive data. One more reason to implement without delay and in an ambitious manner the public policies and measures proposed by the European Green Deal, the Citizens Convention for the climate, etc.

The EU is at risk of a contraction of the total volume of its current sources of oil supply of up to 8% between 2019 and 2030

The probable decline by 2030 of the production capacities of the countries supplying today more than half of the oil consumed by the European Union (EU) is likely to cause significant constraints on its supply.

The EU risks experiencing a contraction in the total volume of its current sources of oil supply of up to 8% between 2019 and 2030, according to an analysis offering an unprecedented detail in a public study, mainly based on estimates of future global crude oil production capacity from the specialized Norwegian economic intelligence agency Rystad Energy.

..............

The graph presents the summary of the extrapolation over the period 2019 - 2030 of the future production profiles of the main EU supplier countries envisaged by Rystad Energy, classified according to the categories presented in the previous section, according to the weight of each of these countries in EU supplies in 2018. This figure 40 shows in particular that more than half of the EU supply sources in 2018 should experience a drop in production between 2019 and 2030.

https://theshiftproject.org/article/ue- ... 030-etude/

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

Remundo wrote:yeah finally we're still at 100 million barrels a day ...

Ah, that's changed a lot.

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

Total does not foresee a decline in oil demand over the next few years

29/09/2020 DOWJONES

The demand for oil has not yet started to decline because it is notably supported by demand from emerging countries, estimated the Chairman and CEO of Total, Patrick Pouyanné, Tuesday during the presentation of the group's energy outlook at the horizon 2050.

Total foresees a plateau in demand "around 2030". "To tell the truth, nobody knows when the peak will be reached", underlined Patrick Pouyanné during an investor day.

"Some think the peak may already be there. It is obvious that the Covid is having a short-term impact. But we are not among those who believe that the demand will not return to the levels of last year", he added.

British group BP had estimated earlier this month that global demand for oil is expected to peak in the coming years. The British major also estimated that oil consumption may never return to the levels reached in 2019.

https://www.google.com/amp/s/investir.l ... 928583.php

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

How Much Oil and Gas Has Been Found in 2020?

by Andreas Exarheas | Rigzone StaffTuesday, November 17, 2020

Global conventional oil and gas discoveries already exceed eight billion barrels of oil equivalent (boe) and are projected to settle at around ten billion boe by the end of the year, according to a new Rystad Energy analysis.

About 3.75 billion boe, or 46 percent of total discovered volumes, are gas while liquid volumes are estimated at 4.31 billion boe, Rystad Energy highlights. Yet-uncounted resources in finds like Sakarya in Turkey point to additional upside, according to the independent energy intelligence company.

Rystad Energy noted that 73 new discoveries have been announced this year through October and pointed out that these are evenly split between land and sea with 36 onshore and 37 offshore. Russia leads in terms of discovery volume, with 1.51 billion boe, while Suriname comes second with 1.39 billion boe and the UAE follows third with 1.1 billion boe, Rystad Energy revealed.

Global conventional discoveries came in at 15.6 billion boe in 2019, 9.5 billion boe in 2018, 11.2 billion boe in 2017, 7.7 billion boe in 2016, 20.3 billion boe in 2015 and 17.1 billion boe in 2014, according to Rystad Energy.

“Global oil and gas operators will chase plenty of additional volumes in wildcats planned for the final two months of 2020, although some may not be completed until early 2021 and will therefore add to next year's tally,” Palzor Shenga, a senior upstream analyst at Rystad Energy, said in a company statement.

Rystad Energy predicts that, in the coming years, annual discovered volumes are likely to settle at a new normal of around 10 billion boe per year. The company said it sees two main reasons for this trend.

“First, oil and gas players are streamlining portfolios and exploration strategies and will pollize prospects more closely than before, thereby reducing the number of wells that will be drilled,” Rystad Energy said in a statement posted on its website.

“Second, companies will be less willing to drill high-risk wells in environmentally sensitive frontier areas, both for financial and environmental reasons,” the company added in the statement.

https://www.rigzone.com/news/how_much_o ... 2-article/

As a reminder, at 90 million bpd, 33 billion barrels of oil should be found each year. Not to mention gas.

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

Oil: IEA reviews global demand down despite stronger fundamentals

AFP published on Jan 19, 2021

The International Energy Agency (IEA) estimates that the oil market is based on more solid fundamentals this year thanks to vaccines, but on Tuesday revised its forecast for the rebound in demand downwards. "The global deployment of the vaccine puts the fundamentals on a more solid trajectory for the year, with both supply and demand returning to growth mode after the unprecedented collapse of 2020," said the IEA in its monthly report on the oil.

However, it slightly revised its demand forecast downwards, by 0,6 million barrels per day (Mb / d) for the first quarter and by around 0,3 Mb / d for the year as a whole. "It will take longer for oil demand to fully recover because new lockdowns in a number of countries are weighing on fuel sales," notes the IEA.

Global demand is now expected to rebound from 5,5 Mb / d in 2021 to 96,6 Mb / d after falling 8,8 Mb / d last year.

On the supply side, during a meeting in early January, OPEC and its partner partners agreed to allow Russia and Kazakhstan to slightly increase their production of black gold during the first quarter. But Saudi Arabia, cautious about the spread of Covid-19, has chosen to impose a significant cut. "The higher demand will allow the supply to start increasing this year," notes the IEA, which forecasts world production to rise by 1,2 Mb / d in 2021 after a record drop of 6,6 Mb / d. j last year.

"A lot more oil will probably be needed, given our forecast of a substantial improvement in demand in the second half of the year," she notes. The agency believes that higher prices could prompt the US shale oil industry to increase production but that companies for now appear to want to maintain current levels, prioritizing debt repayment or returns to investors.

"If they comply with these plans, OPEC + could begin to recover the market share it has lost regularly to the benefit of the United States and others since 2016," predicts the IEA.

https://www.connaissancedesenergies.org ... des-210119

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Re: PeakOil tanker switched to 2005, depletion in 2015?

Global oil consumption collapsed by 9% in 2020.

https://oilprice.com/Latest-Energy-News ... -2020.html

Greta likes this.

EIA: Global Oil Consumption Crashed By 9% In 2020

By Tsvetana Paraskova - Jan 29, 2021,

Due to the coronavirus restrictions and lockdowns, global consumption of petroleum and other liquid fuels crashed by 9 percent to 92.2 million barrels per day (bpd) in 2020, the US Energy Information Administration (EIA) said on Friday, nothing this was the largest drop in EIA's series dating back to 1980.

The world will return to more normal consumer behavior this year, and a continued recovery in economies is set to contribute to rising oil consumption in 2021 as the year progresses. EIA expects in its January Short-Term compared Energy Outlook that global liquid fuels consumption will grow by 5.6 million bpd this year, or by 6 percent to 2020, and rise by another 3.3 million bpd in 2022.

................

https://oilprice.com/Latest-Energy-News ... -2020.html

Greta likes this.

0 x

-

- Similar topics

- Replies

- views

- Last message

-

- 7 Replies

- 15304 views

-

Last message by Noaologue

View the latest post

12/08/15, 16:37A subject posted in the forum : Fossil fuels: oil, gas, coal and nuclear electricity (fission and fusion)

-

- 18 Replies

- 10910 views

-

Last message by dirk pitt

View the latest post

22/09/08, 20:49A subject posted in the forum : Fossil fuels: oil, gas, coal and nuclear electricity (fission and fusion)

Go back to "Fossil energies: oil, gas, coal and nuclear electricity (fission and fusion)"

Who is online ?

Users browsing this forum : No registered users and 332 guests