The return of real estate, finally the prices drop!

Same, not really down at the moment ... Like all, it's been over 2 years that I tell myself that prices will fall. But so far, it's not going down.

Drinking goods at market prices leave quickly, rotten homes do not leave.

But there is so little supply and so much demand that prices do not drop.

My analysis :

This year is a bit special, the elections at the start of the year, the difficulty in borrowing and the fear of losing your job mean that people do not change their accommodation.

-> therefore little offer.

New housing is not a dream, housing of 95m2 on 300m2 of land (at best) along a 2x2 lane for an excessive price (well for the province, everything is obviously relative) ...

The old one freaks out: Asbestos everywhere

Assisted home: poor workmanship in every corner

SixK

Drinking goods at market prices leave quickly, rotten homes do not leave.

But there is so little supply and so much demand that prices do not drop.

My analysis :

This year is a bit special, the elections at the start of the year, the difficulty in borrowing and the fear of losing your job mean that people do not change their accommodation.

-> therefore little offer.

New housing is not a dream, housing of 95m2 on 300m2 of land (at best) along a 2x2 lane for an excessive price (well for the province, everything is obviously relative) ...

The old one freaks out: Asbestos everywhere

Assisted home: poor workmanship in every corner

SixK

0 x

- chatelot16

- Econologue expert

- posts: 6960

- Registration: 11/11/07, 17:33

- Location: Angouleme

- x 264

the price of materials does not drop

the price of labor does not drop

so construction prices cannot go down, unless we want to settle for smaller and simpler

outside the mandatory standards increase ... you need 36 electrical outlets in each room, you need double glazed windows ... you need a tiled roof 4 times more expensive than corrugated iron ... you need thermal insulation not even durable, while insulation from the outside could be cheaper if we did not put sticks in the wheels

so the prices go up even more ... and that drives up even the price of slums which some have to settle for

the worst problem is not the price of real estate, but the drop in purchasing power, which no longer corresponds to the price of available housing

the price of labor does not drop

so construction prices cannot go down, unless we want to settle for smaller and simpler

outside the mandatory standards increase ... you need 36 electrical outlets in each room, you need double glazed windows ... you need a tiled roof 4 times more expensive than corrugated iron ... you need thermal insulation not even durable, while insulation from the outside could be cheaper if we did not put sticks in the wheels

so the prices go up even more ... and that drives up even the price of slums which some have to settle for

the worst problem is not the price of real estate, but the drop in purchasing power, which no longer corresponds to the price of available housing

0 x

- sherkanner

- Éconologue good!

- posts: 386

- Registration: 18/02/10, 15:47

- Location: Austria

- x 1

chatelot16 wrote:the price of materials does not drop

the price of labor does not drop

so construction prices cannot go down, unless we want to settle for smaller and simpler

outside the mandatory standards increase ... you need 36 electrical outlets in each room, you need double glazed windows ... you need a tiled roof 4 times more expensive than corrugated iron ... you need thermal insulation not even durable, while insulation from the outside could be cheaper if we did not put sticks in the wheels

so the prices go up even more ... and that drives up even the price of slums which some have to settle for

the worst problem is not the price of real estate, but the drop in purchasing power, which no longer corresponds to the price of available housing

This is only true of new buildings (and again), and does not explain everything.

Because of state interventionism (plans sealer and others before him) we witnessed in the early 2000s an explosion in demand from investors.

Housing prices, both new and old, have increased substantially, as have land prices (which also partly explains the rise in new prices).

Investors have realized that buying housing in order to rent it is more profitable and safer than investing in the stock market, even if the yield is lower, although still good (it turns out to be 3 to 5%).

Standards as you mentioned does not help to reduce the construction bill (or even maintenance or security).

If we compare the rental prices and the purchase price of the same property, we realize that they are completely disconnected.

You must rent the property a minimum of 25 years on average to reach the target nest egg. If you wish to buy it, you must also include the price of the credit, and you can rent the property not far from 40 years before paying it (Calculation not done myself, by my home, but the situation in France is the same, even worse).

0 x

When we work, we must always give 100%: 12% on Monday; 25% Tuesday; 32% Wednesday; 23% on Thursday; and 8% on Friday

You say at the same time that:

1> you can rent the property not far from 40 years before having paid for it

2> investors have realized that buying housing in order to rent it is more profitable

A little contradictory, right? In truth, buying to rent doesn't bring in anything anymore (apart from tax exemption, and more) because the prices are much too high. In addition, the flow-style leftists who make announcements like "we're going to disadvantage landlords even more and overprotect tenants" are well understood by investors who note "we're going to be even more taxed and pissed off, so it's not worth it. ".

Investment in rental property is down.

> the worst problem is not the price of real estate, but the

> decrease in purchasing power, which no longer corresponds to the price of available housing

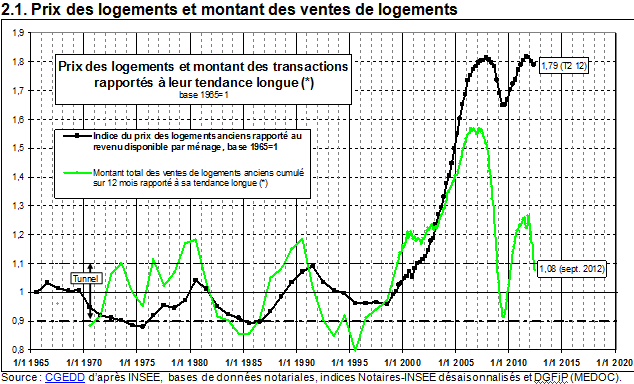

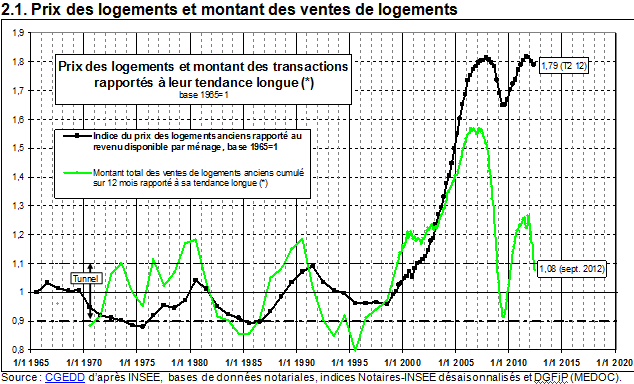

Friggitt, black curve, represents the price of housing relative to income (ie 1 year salary in 1999 buys the same thing as 1.8 years now).

(link for details)

The price of construction is not really the problem. The construction is worth in the 800 to 1200 € / m² depending on the quality, which is reasonable (much less if you buy out of water / air and you finish it yourself). Of course, there is already a lot of tax in there ...

The problem is the scarcity of land created by restrictive planning laws which prohibit building. Without that, the curve would have been flat, there would have been no bubble, everyone could find accommodation easily, and there would be no need for social housing (another aberration).

1> you can rent the property not far from 40 years before having paid for it

2> investors have realized that buying housing in order to rent it is more profitable

A little contradictory, right? In truth, buying to rent doesn't bring in anything anymore (apart from tax exemption, and more) because the prices are much too high. In addition, the flow-style leftists who make announcements like "we're going to disadvantage landlords even more and overprotect tenants" are well understood by investors who note "we're going to be even more taxed and pissed off, so it's not worth it. ".

Investment in rental property is down.

> the worst problem is not the price of real estate, but the

> decrease in purchasing power, which no longer corresponds to the price of available housing

Friggitt, black curve, represents the price of housing relative to income (ie 1 year salary in 1999 buys the same thing as 1.8 years now).

(link for details)

The price of construction is not really the problem. The construction is worth in the 800 to 1200 € / m² depending on the quality, which is reasonable (much less if you buy out of water / air and you finish it yourself). Of course, there is already a lot of tax in there ...

The problem is the scarcity of land created by restrictive planning laws which prohibit building. Without that, the curve would have been flat, there would have been no bubble, everyone could find accommodation easily, and there would be no need for social housing (another aberration).

0 x

- sen-no-sen

- Econologue expert

- posts: 6856

- Registration: 11/06/09, 13:08

- Location: High Beaujolais.

- x 749

For about 6 months now, we can notice a fall in real estate in certain secondary cities.

In very large cities, this drop remains fairly timid but should rapidly increase.

In some time there will be as mentioned above, a sharp decrease in property prices, this is a certainty, because all the indicators are down, except that of poverty ...

In very large cities, this drop remains fairly timid but should rapidly increase.

In some time there will be as mentioned above, a sharp decrease in property prices, this is a certainty, because all the indicators are down, except that of poverty ...

0 x

"Engineering is sometimes about knowing when to stop" Charles De Gaulle.

> In some time there will be as mentioned above,

> a sharp drop in real estate prices

A bubble is like an aneurysm, you know it's going to blow up, but you can never know when. This one only lasted too long and causes a lot of damage (especially among the non-rich!) But it can take another 5 years (or not).

Here, take your Case-Schiller index of American real estate prices:

We see 2 types of curves, flat and hunchbacks. The flat is where there was no bubble. The main explanation is that it is the corners where there is no stupid planning regulations like ours. For example, Dallas, TX, which is very rich, no bubbles: normal, there is no shortage of land by law. The worst among the hunchbacks are in California where it is the madness of the PLU, as with us! Sad, right?

> a sharp drop in real estate prices

A bubble is like an aneurysm, you know it's going to blow up, but you can never know when. This one only lasted too long and causes a lot of damage (especially among the non-rich!) But it can take another 5 years (or not).

Here, take your Case-Schiller index of American real estate prices:

We see 2 types of curves, flat and hunchbacks. The flat is where there was no bubble. The main explanation is that it is the corners where there is no stupid planning regulations like ours. For example, Dallas, TX, which is very rich, no bubbles: normal, there is no shortage of land by law. The worst among the hunchbacks are in California where it is the madness of the PLU, as with us! Sad, right?

0 x

-

moinsdewatt

- Econologue expert

- posts: 5111

- Registration: 28/09/09, 17:35

- Location: Isére

- x 554

Towards a 3 to 3,5% decline in property prices in 2013

November 21 2012

Real estate prices are down

The National Federation of Real Estate (FNAIM) forecasts a fall in prices of old housing from 3 to 3,5% in 2013. This movement of lower prices has already started significantly this year, because, for the whole of In 2012, the decline expected by Fnaim amounts to 1,5% to 2%.

The capital is not to be outdone since "in Paris, prices have been falling for two months", indicates Gilles Ricour de Bourgies, president of the Fnaim chamber for Paris-Ile-de-France, who adds that in the City Light, "the drop is 2%".

Reasons and consequences of falling prices on the real estate market

This downward trend in property prices, closely linked to a fall in demand, is mainly due to the refocusing of the PTZ + on new properties which discouraged a large number of first-time buyers, to a tightening of the conditions for granting loans by the banks, to the rise in unemployment ... But despite this decline in the real estate purchasing power of households, the sellers are still reluctant to sharply lower their prices. Consequences: the number of housing sales plummets, and professionals in the sector are worried, because many jobs are threatened with disappearance.

« This year, we will have completed 687.000 transactions against 805.000 in 2011 ", Says Jean-François Buet, president-elect of FNAIM, who will take office in January 2013, and who fears job losses amounting to" 10.000 this year ".

"Today to sell you have to come to your senses and accept lower prices," says Buet.

http://www.partenaire-europeen.fr/Actua ... 3-20121122

0 x

- chatelot16

- Econologue expert

- posts: 6960

- Registration: 11/11/07, 17:33

- Location: Angouleme

- x 264

this drop in sales could have a positive effect: pushing those who cannot sell to rent

alas it will not work: to rent it is mandatory to comply with all standards, otherwise the owner has no rights, and the tenant can take advantage of it to never pay

conclusion of the housing for sale will remain unused because the owner will not have the means to do the compulsory work

alas it will not work: to rent it is mandatory to comply with all standards, otherwise the owner has no rights, and the tenant can take advantage of it to never pay

conclusion of the housing for sale will remain unused because the owner will not have the means to do the compulsory work

0 x

> to rent it is compulsory to respect all the standards

Not necessarily, just the decency criteria, and the housing must meet the standards of the year of its construction or last complete renovation, and not present any dangers (lead, asbestos, questionable electrical installation, etc.).

Of course, to rent in good conditions and to have tenants who are not too lousy, you have to invest in renovation.

However, given the prices of real estate, rents, and the risks involved in renting, it is not profitable to invest ...

Urban artist

1) not all accommodation for sale is suitable for rental: you have to see the type of accommodation, location, etc.

2) if the accommodation was your main residence (or other conditions), no capital gains tax. Renting reactivates capital gains tax, so it's prohibitive.

So there are a lot of slums that will remain slums, it's a shame.

Not necessarily, just the decency criteria, and the housing must meet the standards of the year of its construction or last complete renovation, and not present any dangers (lead, asbestos, questionable electrical installation, etc.).

Of course, to rent in good conditions and to have tenants who are not too lousy, you have to invest in renovation.

However, given the prices of real estate, rents, and the risks involved in renting, it is not profitable to invest ...

Urban artist

1) not all accommodation for sale is suitable for rental: you have to see the type of accommodation, location, etc.

2) if the accommodation was your main residence (or other conditions), no capital gains tax. Renting reactivates capital gains tax, so it's prohibitive.

So there are a lot of slums that will remain slums, it's a shame.

0 x

Who is online ?

Users browsing this forum : No registered users and 131 guests