on the other hand in France, a 29% increase in sales of new homes .....

The return of real estate, finally the prices drop!

- elephant

- Econologue expert

- posts: 6646

- Registration: 28/07/06, 21:25

- Location: Charleroi, center of the world ....

- x 7

uoi, but on Actu 24 ( www.actu24.be), this morning they say that prices are falling (except apartments)

on the other hand in France, a 29% increase in sales of new homes .....

on the other hand in France, a 29% increase in sales of new homes .....

0 x

elephant Supreme Honorary éconologue PCQ ..... I'm too cautious, not rich enough and too lazy to really save the CO2! http://www.caroloo.be

-

Christophe

- Moderator

- posts: 79304

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11037

Here is the kind of article written by defenders of landlords, landlord or other real estate company: we would almost complain ...

Source: http://www.20minutes.fr/article/344815/ ... elatif.php

Floor prices. While rental prices fell 0,8% nationally, they have fallen 2,4% in Strasbourg since January. Apartments in the Alsatian capital would thus trade on average 11 euros per square meter.

“The 2,4% drop seems a bit high to me. Especially since we do not know according to which panel of properties, or in which districts was carried out this survey, estimates for its part Gérard Durr, president of the National Federation of real estate (Fnaim) Alsace. In addition, things have to be put into perspective. On a rent of 400 euros, 2,4% represents only about 8 euros. Can we therefore speak of a real decline? It is more of a rounding phenomenon. If I have a property worth 352 euros, I will offer it at 350 euros and even 349 euros to be more commercial. "

Rather than a fall in prices, Gérard Durr prefers the term "stabilization" of rents, prices should not, according to him, change much in the times to come. A 35 m2 studio, located rue de l'Ail, is currently offered at 400 euros, or 11,43 euros per square meter. Another of 32 m2, near Place Kléber, is sold for 480 euros or 15 euros per square meter. Finally, a seven-room apartment of 252 m2, rue du Maréchal-Joffre, is displayed at 10,71 euros per square meter (2 euros). W

Philippe wendling

Source: http://www.20minutes.fr/article/344815/ ... elatif.php

0 x

Do a image search or an text search - Netiquette of forum

http://www.marc-candelier.com/article-27552314.html

the small history of real estate ...

the small history of real estate ...

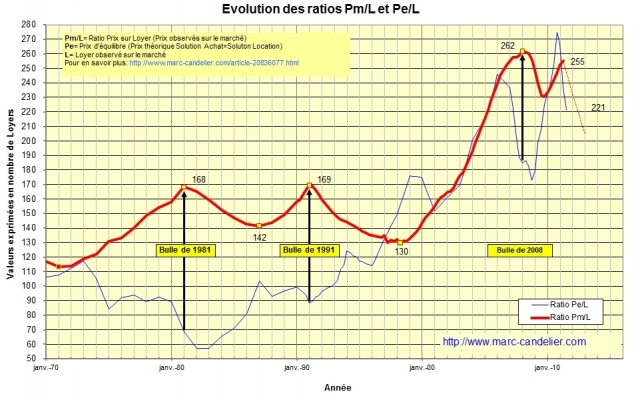

Did you know that in 1958 a home was worth on average 70 rents and that 40 years later, in 1998, it was necessary to spend on average 133 rents to become a homeowner? Did you know that in 2008, at the height of the bubble, housing cost on average 262 rents and that prices were overestimated by 80%?

0 x

Be your own torch, your own refuge, your own master ... "

-

Christophe

- Moderator

- posts: 79304

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11037

Update 1st quarter 2011, it starts up again ...

http://www.marc-candelier.com/article-i ... 70433.html

Also re-read the intro of this site (info already passed but it does not hurt to repeat ..)

Thank you, really, to all the bankers, real estate and financial speculators ... and others who weigh on youth ...

Read also (at least): http://www.marc-candelier.com/article-i ... 01205.html

et http://www.marc-candelier.com/article-f ... 29284.html

http://www.marc-candelier.com/article-i ... 70433.html

The graph above gives you, over a period of more than 40 years, the evolution of the Price / Average rent ratio of old dwellings for mainland France. The indicator is calculated from data developed by INSEE:

Quarterly price index for old housing - Metropolitan France - Overall - CVS index (Base 100 in 4th quarter 2000).

Consumer price index - CPI - All households - Metropolitan France - by consumption function - Rents for main residences

The INSEE figures are reliable but known with a delay of 3 to 6 months. To get a benchmark, I extended the curve (red dotted line) on the basis of a price decrease of 10% per year and an increase in rents of 2% per year.

This graph is updated every 3 months, as soon as the INSEE figures are available.

Also re-read the intro of this site (info already passed but it does not hurt to repeat ..)

Hello and thank you for your visit,

Did you know that in 1958 a home was worth on average 70 rents and that 40 years later, in 1998, it was necessary to spend on average 133 rents to become a homeowner? Did you know that in 2008, at the height of the bubble, housing cost on average 262 rents and that prices were overestimated by 80%?

The objective of this blog is to allow you to follow the news of the real estate market and to help you understand why prices can go up but also go down. So you can buy, sell or rent your home knowing exactly where you are setting foot.

Thank you, really, to all the bankers, real estate and financial speculators ... and others who weigh on youth ...

Read also (at least): http://www.marc-candelier.com/article-i ... 01205.html

et http://www.marc-candelier.com/article-f ... 29284.html

0 x

Do a image search or an text search - Netiquette of forum

-

Christophe

- Moderator

- posts: 79304

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11037

Interactive history of property prices in Paris: http://www.lemonde.fr/economie/infograp ... _3234.html

0 x

Do a image search or an text search - Netiquette of forum

-

Christophe

- Moderator

- posts: 79304

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11037

A cloud of hope for young people?

http://www.challenges.fr/actualite/econ ... paris.html

REAL ESTATE Prices are melting everywhere except in Paris

04-10-11 at 18:48 by the editorial staff of Challenges.fr

The new taxation on real estate capital gains and the rise in loan rates lowered the prices of old housing in the Province in the third quarter ... But Paris continues to beat record on record.

Fewer and fewer buyers and prices starting to drop ... Is the bubble really exploding? According to the latest study by the Century 21 estate agency network, "sales of second-hand homes in France fell by 11% between the third quarters of 2010 and 2011". And Laurent Vimont, its president, to specify that "prices fell by 2,7% between the 1st half and the 3rd quarter of 2011".

Parisian exception

Only Paris, due to demand still much stronger than supply, sees its prices continue to rise to reach a new record of 8.556 euros / m2 in the third quarter (against a median price of 8.150 euros / m² in the second quarter), says the Century 21 study.

The capital thus remains the city of all excesses, with a price surge of 22,5% in the second quarter, the strongest in one year for 20 years, which values the Parisian residential property stock at an astonishing level: nearly 650 billion euros according to an exclusive study by Challenges and Meillèresagents.com.

But beyond the borders of the capital region, real estate is no longer a rising value. And, still according to Century 21, owners who want to sell their property must now agree to seriously revise their ambitions downwards. Among the biggest falls, are Burgundy at -9,7%, the Center at -5,5%, Lorraine at -4,4%, the Provence-Alpes-Côte d'Azur region at -3,7 %, and Nord-Pas-de-Calais-Picardie at -3,4%.

The impact of the real estate capital gains tax pointed out

In question, according to the Guy Hocquet network, questioned by AFP, "the rise in mortgage rates and the presidential election", both of which will continue to lead to an overall decline in the markets in 2012.

Another factor favoring the decline, the new tax on real estate capital gains on sales of rental housing and second homes, effective on February 1, 2012. With it, professionals noted a "significant increase in the number of sales mandates in the agencies "indicates Nicolas Jacquet, Executive Chairman of Urbania.

An impact which, on the other hand, favors luxury real estate. "We have recorded a 20% increase in the number of mandates because the promises to sell must be signed before November 15 to be sure that the final deeds can be registered with notaries before February 1", confides to AFP Charles-Marie Jottras, chairman of the real estate consulting firm Daniel Féau.

http://www.challenges.fr/actualite/econ ... paris.html

0 x

Do a image search or an text search - Netiquette of forum

So I don't know if it's representative, but that's what we found.

We have been looking more or less to buy something for almost 1 year. There has indeed been a slight decrease since this summer.

But a few weeks ago, when we signed the compromise for the house that interests us, the notary told us that they now had many more visits than before.

According to him it is the conjunction of two things:

- Given the fluctuations of the financial system, everyone is afraid of future difficulties in obtaining credit. All those who have a real estate project and who can reasonably afford it advance the date of completion of the purchase project.

- Always because of the same fluctuations, those who have a lot of money on their side and who are afraid of losing it, are looking for a safe investment even if it does not perform well (it is better not to gain anything rather than losing everything) real estate offers this security.

These two reasons mean that, I think, prices will not fall for a long time and that an increase is to be feared in a short time.

We have been looking more or less to buy something for almost 1 year. There has indeed been a slight decrease since this summer.

But a few weeks ago, when we signed the compromise for the house that interests us, the notary told us that they now had many more visits than before.

According to him it is the conjunction of two things:

- Given the fluctuations of the financial system, everyone is afraid of future difficulties in obtaining credit. All those who have a real estate project and who can reasonably afford it advance the date of completion of the purchase project.

- Always because of the same fluctuations, those who have a lot of money on their side and who are afraid of losing it, are looking for a safe investment even if it does not perform well (it is better not to gain anything rather than losing everything) real estate offers this security.

These two reasons mean that, I think, prices will not fall for a long time and that an increase is to be feared in a short time.

0 x

-

Christophe

- Moderator

- posts: 79304

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11037

Yes it defends Forhorse! In all cases, there is a good chance that we will never return to the level before 2000 (in purchasing power parity) ...

In this regard, here is a summary file on real estate prices with interesting curves: http://www.journaldunet.com/economie/im ... mmobilier/

It starts here: http://www.journaldunet.com/economie/im ... ents.shtml

In this regard, here is a summary file on real estate prices with interesting curves: http://www.journaldunet.com/economie/im ... mmobilier/

Real estate: what professionals do not say

After a decade of growth, a major setback in 2008 and a slight recovery since then, the health of the real estate sector is highly commented. And professionals keep reassuring owners and future buyers as much as possible about the state of the market. There are many questions for the latter. Should we sell now? Buy? Will prices hold steady, continue to rise or collapse without warning? To answer it, the Journal du Net is trying to break some clichés on the real estate situation in France.

It starts here: http://www.journaldunet.com/economie/im ... ents.shtml

0 x

Do a image search or an text search - Netiquette of forum

- sherkanner

- Éconologue good!

- posts: 386

- Registration: 18/02/10, 15:47

- Location: Austria

- x 1

Christophe wrote:Yes it defends Forhorse! In all cases, there is a good chance that we will never return to the level before 2000 (in purchasing power parity) ...

In this regard, here is a summary file on real estate prices with interesting curves: http://www.journaldunet.com/economie/im ... mmobilier/

Uplifting.

Thanks for the links.

0 x

When we work, we must always give 100%: 12% on Monday; 25% Tuesday; 32% Wednesday; 23% on Thursday; and 8% on Friday

-

Christophe

- Moderator

- posts: 79304

- Registration: 10/02/03, 14:06

- Location: Greenhouse planet

- x 11037

Nothing sherkanner but it was for nothing because ultimately it does not drop but it ... fuck a lot!

Source: http://www.liberation.fr/societe/010123 ... -trimestre

Forhorse was right I think ...

The price of old homes up 7,8% in the second quarter

The prices of old homes increased by 7,8% in France in the second quarter of 2011 over a year, still boosted by the jump in the Paris market (+ 22,5%), according to the final notaries-Insee index published on Wednesday.

Over one year, "the increase in prices remains strong overall", after a first quarter at + 8,7%: + 10,3% for apartments and + 5,3% for houses, underlines the monthly economic report for Notaries of France.

For the province, house prices even increased more than apartment prices (4,9% compared to 3,8%). The increase is around 10% in Lille and Nantes.

On the other hand, the price of apartments has been falling for two quarters in six departments: Allier, Calvados, Charente-Maritime, Somme, Var and Vosges. That of houses has been falling for two consecutive quarters in three departments: Meurthe-et-Moselle, Pyrénées-Orientales, Deux-Sèvres.

The number of transactions for old homes is estimated at 812.000 over the 12 months from July 2010 to June 2011, an increase of 16% compared to the same period a year earlier, but down compared to the increase observed at the end December 2010 (+ 32%).

(AFP source)

Source: http://www.liberation.fr/societe/010123 ... -trimestre

Forhorse was right I think ...

0 x

Do a image search or an text search - Netiquette of forum

Who is online ?

Users browsing this forum : No registered users and 59 guests