Debate on debt and pretense

Tuesday July 19 2011

Wall Street Letter | THE WORLD

Between ideology and political issues, the debate on raising the debt "ceiling" in the United States gives the impression of a shadow theater. Almost nothing of the words and actions of the protagonists that is not imbued with hidden interests, nothing or almost that is not based on the conviction that oblivion or ignorance are stronger than anything. Two striking examples illustrate this mixture of instrumentalization and voluntary amnesia which leaves aside the fundamental questions and begins to tire of an opinion which struggles to follow a debate where the sincerity of the protagonists is not the major characteristic.

Let's start with the Republicans. Formally, they claim to make the reduction of the debt - more exactly of its rate in relation to the gross domestic product (GDP) - a matter of "principles". But it is largely a posture. Their real battle horse - imposed for the moment by their radical fringe of the Tea Party and certain major lobbies which finance their elected officials - is the massive reduction in the state of life in order to prevent it from acting, which is not the same.

We had already mentioned the way in which Republican elected officials block nominations and funding from federal agencies to promote deregulation (“Nobel Prize? Incompetent!” Le Monde, June 22). Rarely has this attitude been made as visible as in the recent decision of the House Committee on Appropriations Committee to refuse to vote on the budget of the Securities & Exchange Commission (SEC), the policeman of the markets.

From the crisis, this organization was released very discredited. The SEC had not investigated six times on the scammer Bernard Madoff without success? Let the bubble of real estate debt swell recklessly until it implodes? For many, her fate was sealed: she would be at best profoundly reformed, at worst doomed. The Obama administration hesitated and ended up ... giving it more prerogatives.

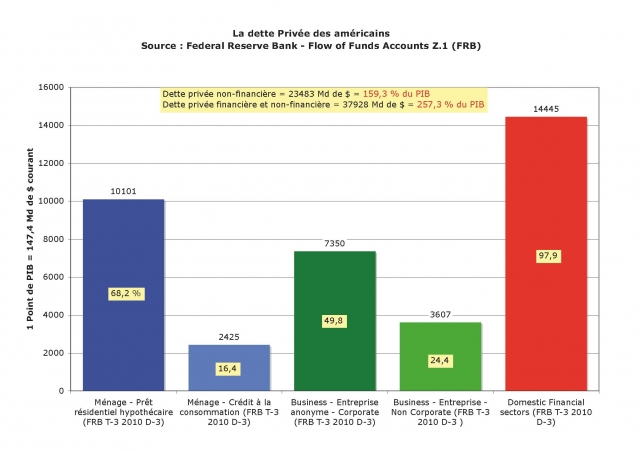

The Dodd-Frank law of financial regulation allocated more investigators and specialists better trained to detect white collar fraudsters and speculators at risk. The Republican majority in the House, however, canceled its allocation of 222,5 million dollars (158 million euros) additional provided for in its 2012 budget, to keep it unchanged (ie, in constant dollars: - 2,5%). Reason given: faced with "a cumulative federal deficit exceeding $ 14 trillion in debt", spending less becomes an imperative for everyone.

But this is a trick. If the SEC is a public body, its funding is not: it comes entirely from the compulsory contributions of 35 players in the American markets. They are the ones who will contribute less, and the agency which will be less able to pursue their bad apples. The public deficit will not have been reduced by a single cent. Worse, noted Robert Khuzami, number two in the SEC, his organization is a net contributor to the state budget, due to the fines it imposes on financiers who disrespect its rules: the more it can sue, the more it brings money back to taxpayers. In short, on the pretext of "reducing public spending", the deficit is widened a little more ...

On the Democrats' side, the debate highlights a truly astonishing de facto alliance: that of the White House and the rating agencies. Staggering, when we remember what these same Democrats could have said, three years ago, when public opinion expressed an acute rejection of the actors of Wall Street and that the authority of these agencies, of which they are the clients and financial, seemed irreparably deteriorated. These Standard & Poor's, Fitch and other Moody's were accused of having let AIG, Fannie Mae, Freddie Mac and company take on astronomical debt at risk without ever downgrading their rating, of having acted in the same way with the companies of faithless credit and other institutions that structured their "rotten" titles. It was a time when Treasury Secretary Tim Geithner assured that, under his administration, "the dependence of investors and regulators on rating agencies will be reduced."

Since then, however, these agencies have only been very poorly regulated. And they are making rain and shine in the global debt market today. The role of these champions of reducing deficits with clear cuts has swelled to the point of dictating their law to States paralyzed by the threat of a possible degradation of their debt rating. And, as they threaten Washington to do so, how does the same Mr. Geithner react? Rather than remember his ferocious remarks about them in the past, he hastens to try to profit politically from their threats to get the Republicans to agree to an agreement on the terms of the reduction of the debt ratio. American less in accordance with the wishes of his radical faction of the Tea Party. Obama-Standard & Poor's same fight: who would have believed?

Meanwhile, the real problems of American debt, those of an aging society that produces more than 10% of what it consumes and expends immensely more than any other in military and health costs (for a result, in this last area, which is much lower than comparable countries), remain far from public debate.

Sylvain Cypel

Source

http://www.lemonde.fr/economie/article/ ... _3234.html